Many Wal-Mart Stores suppliers are saying no to new storage fees and a payment schedule that could delay payment for months. In an effort to re-invigorate margins, Wal-Mart sent a letter in June this year to some 10,000 suppliers advising their suppliers of new fees which would be imposed upon them such as a 1% warehouse use fee, 1% distribution center use fee, and premium fees for new store penetration.

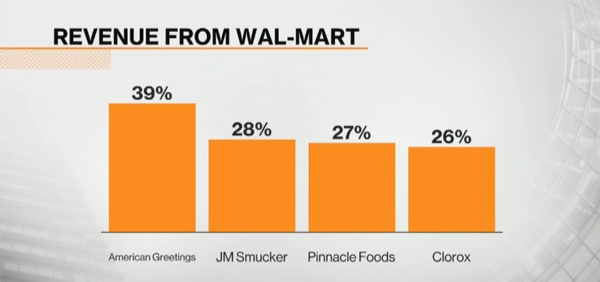

Perhaps the straw that broke the proverbial camel’s back is the new policy that ties vendor payment to inventory turnover. So, if a vendor now has a standard 30-day pay arrangement, they will now be paid in the length of time it takes for their inventory to turn over, 60, 90, 120 days possibly. The already thin margins for Wal-Mart suppliers are exacerbated by their potential cash flows being in jeopardy. These seemingly small percentage fees imposed by the retail giant can add up to significant amounts for some of Wal-Mart’s major suppliers, as illustrated below.

Wal-Mart spokeswoman Deisha Barnett had this to say about the new policy. "Wal-Mart is willing to negotiate with suppliers and takes into account many factors such as history with the vendor and quality of the products to decide if the relationship is worth continuing". To help suppliers adjust to the less frequent payments, Wal-Mart is encouraging them to seek low-interest loans through an existing financing program. But those that don’t agree to the new terms may find their Wal-Mart business affected. The arrogance of this statement is difficult to miss. Any retailer the size of Wal-Mart is expected to leverage its B2C strength to its advantage. Wal-Mart plays viciously in this arena.

The Cost Of Not Playing Ball With Wal-Mart

Wal-Mart has made it very clear to suppliers that don’t agree to all or some of the new terms that there will be a cost. Shelf space reductions, product placement demotions or termination of supplier relationship are all options for vendor non-compliance. With nearly $500 billion in sales last year, Wal-Mart is the largest customer for many packaged goods companies, such as General Mills Inc., Kellogg Co. and Hanes brands Inc., which get more than 20 percent of their revenue from Wal-Mart, according to data compiled by Bloomberg. For these companies and many others difficult decisions lie ahead. They cannot afford to lose business volumes and minimum profit margins must be maintained. Intense cost analysis and cost reduction will be critical in their decision to continue with Wal-Mart.

Costs Roll Downhill

If management of these major suppliers cannot successfully roll back the new fees, the companies will pass the increases on to its own suppliers and service providers. The driver shortage in the trucking industry will likely insulate carriers from the cost pass through attempts. Cost increases to smaller retail customers will likely result in ultimately higher consumer pricing. Smaller suppliers will have limited options for cost cutting to meet Wal-Mart’s new policy. Labor reductions may be their only viable option. Short term financing is another possibility but in the long term this desperate strategy will not sustain profitability given the thin margins. A Retail Consultant executive commented, "While the charges could be painful, the investments Wal-Mart is making in its stores, website and supply chain will benefit suppliers in the long run. “These fees are a result of a new retail reality. This is the price of not just selling things to Wal-Mart, but leveraging Wal-Mart’s massive platform.” It looks very much like Wal-Mart may be the new normal.

For information on supply chain balance, click the button below.

Land-Link, a well respected professional organization, has been providing its clients with effective transportation and logistics solutions since 1978.

Land-Link, a well respected professional organization, has been providing its clients with effective transportation and logistics solutions since 1978.