Just when you thought the pandemic was coming to an end Shanghai is in a strict lockdown attempting to contain a resurgence of Covid cases. Shanghai authorities began an immediate lockdown of the city’s 26 million residents late on Sunday after mass testing found "large-scale" COVID-19 infections throughout the financial hub. “Even a sporadic and short-live Covid resurgence could bring notable shocks to consumption and continue to weigh on consumer confidence for months after the Covid wave subsides,” Bank of America analysts wrote. With the exception of falling crude oil prices, all of the fallout will likely have negative effects worldwide.

Read More

Topics:

Supply Chain Management,

Third Party Logistics,

Freight Bill Auditing,

Intermodal Freight,

Transportation News,

Reducing Freight Rates,

Maximizing Routing Efficiencies,

Freight Bill Audit,

Shipping News,

Logistics News,

Industry Trends,

Technology,

dimensional pricing

Super shippers are renting entire cargo vessels @ $200,000 per day to ensure seasonal deliveries. Euroseas (NASDAQ: ESEA) confirmed this week that it chartered its 2009-built, 4,250-twenty-foot equivalent unit container ship Synergy Oakland for 60-85 days at a gross rate of $195,000-$202,000 per day starting in the second half of October.

Read More

Topics:

Supply Chain Management,

Third Party Logistics,

Freight Bill Auditing,

Intermodal Freight,

Transportation News,

Reducing Freight Rates,

Maximizing Routing Efficiencies,

Shipping News,

Logistics News,

Industry Trends,

Technology,

dimensional pricing

Canadian Truckers Alliance Protest Is Gaining Traction

Read More

Topics:

Supply Chain Management,

Third Party Logistics,

Intermodal Freight,

Transportation News,

Logistics Business,

Maximizing Routing Efficiencies,

Freight Bill Audit,

3D Printing,

Shipping News,

Logistics News,

Industry Trends,

Technology,

dimensional pricing

With the economic recovery gaining steam amid an uncertain pandemic path, companies are scrambling to deal with increasing commodity prices, supply constraints, and higher wages caused by labor shortages. According to the U.S. Division of Labor Statistics in December, the Consumer Price Index for All Urban Consumers rose 0.5 percent, seasonally adjusted, and rose 7.0 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.6 percent in December; up 5.5 percent over the year.

Read More

Topics:

Third Party Logistics,

Freight Bill Auditing,

Reducing Freight Rates,

Maximizing Routing Efficiencies,

Shipping News,

Logistics News,

Industry Trends

To enlighten those less informed about the Transportation industry I routinely remind them that everything around their home, work and recreation areas spent some time on a truck at one time. The sheer size of the United States requires a reliable distribution infrastructure. Just consider what the railroad did for the opening up of the west and feeding the rest in the 1800’s. The need for transportation is much greater today. We built the national infrastructure. Now we must continuously support it; literally, every day.

Read More

Topics:

Supply Chain Management,

Third Party Logistics,

Freight Bill Auditing,

Intermodal Freight,

Transportation News,

Reducing Freight Rates,

Logistics Business,

Maximizing Routing Efficiencies,

Freight Bill Audit,

3D Printing,

Shipping News,

Logistics News,

Industry Trends,

Technology,

dimensional pricing

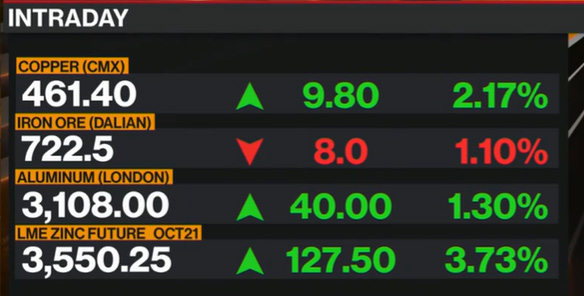

A surge in energy and metal prices is offering investors a fresh reminder of how the commodities market can fuel inflation and imperil the post-pandemic economic recovery.

Read More

Topics:

Supply Chain Management,

Third Party Logistics,

Intermodal Freight,

Transportation News,

Reducing Freight Rates,

Logistics Business,

Maximizing Routing Efficiencies,

3D Printing,

Shipping News,

Logistics News,

Industry Trends,

Technology,

dimensional pricing

There are so many unanswered questions surrounding the effects of the Covid-19 Virus to date. Where did the standard flu go? Is the Covid-19 virus threat over? Will the Covid variant force us back to a global lockdown? The stock market seems to think perhaps.

Read More

Topics:

Third Party Logistics,

Freight Bill Auditing,

Transportation News,

Reducing Freight Rates,

Logistics Business,

Maximizing Routing Efficiencies,

Shipping News,

Industry Trends,

Technology

The massive cargo ship Ever Given has been freed from the shores of the Suez Canal after 6 days of complete traffic blockage. Over the weekend, 14 tugboats pulled and pushed the Ever Given at high tide to try to dislodge it and were able to move the ship "30 degrees from left and right".

Read More

Topics:

Third Party Logistics,

Intermodal Freight,

Transportation News,

Maximizing Routing Efficiencies,

Shipping News,

Logistics News,

Technology

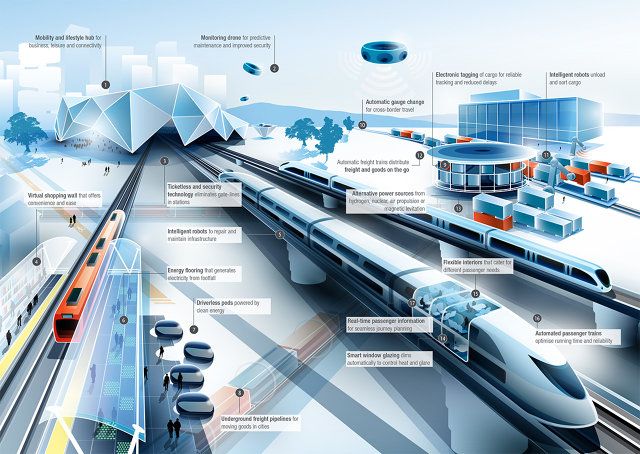

There is little doubt that technology has transformed the Logistics business in the last several years. Will we ever get to fast enough or efficient enough? It's not likely. Under pressure exerted by demand for instant gratification, new tech-first logistics providers are beginning to pervade the fulfillment environment. Without the autonomous hardware that promises to supersede traditional road transportation, they are instead leveraging digital tools to improve the performance of manually executed deliveries and reduce lead times from days to hours, with 24 being today’s bargain-basement service level. These companies, through the use of customer-integrated business platforms, mobile technology, and crowd-sourcing, are finding ways to pick orders within minutes of receiving them, dispatch deliveries on-demand, and bring buyer’s purchases to them in time-frames of two hours or even less. How are logistics professional going to keep this pace? Here are some technology trends that may be worth a look as we enter 2021 and beyond.

Robotics

Given the energy and investment in robotics in our space, suggesting that there will be a robotics trend in 2021 is pretty obvious. After all the pilots and promises, what seems to be happening is that robot solution providers, and the end user community, are realizing that there is no one size fits all robotic applications. Quite the opposite is true. The customization is proving so complicated due to the advanced operations of the robots that the programming and engineering has become problematically complicated. Robotic applications are a very customized solution depending upon the product line, distribution protocols and warehouse volume parameters. The challenge, in addition to the design, will be the management system that can bring the components in synchronicity with the rest of the automation. The difficulty seems to be that there is no standardization among the robotic providers. Each have their own standards, communication protocols and capabilities. Someone will have to figure all of that out as robots proliferate. The next generation robots will not just be tasked with simply, repetitive and mundane projects as were the first generation. The robots of today will be much more complicated providing a wide range of services. As you increase the tasks you increase both the software and hardware configurations necessary to support the project. These ambitious goal will certainly be a challenge to the engineers and programmers.

Edge Computing

Read More

Topics:

Third Party Logistics,

Freight Bill Auditing,

Intermodal Freight,

Transportation News,

Maximizing Routing Efficiencies,

Freight Bill Audit,

Shipping News,

Logistics News

Technology is affecting transportation modes through the roads, sky and water. Advancements in speed and efficiency may come at some cost.

Read More

Topics:

Intermodal Freight,

Reducing Freight Rates,

Logistics Business,

Maximizing Routing Efficiencies,

Freight Bill Audit,

Shipping News,

Logistics News,

Industry Trends

Land-Link, a well respected professional organization, has been providing its clients with effective transportation and logistics solutions since 1978.

Land-Link, a well respected professional organization, has been providing its clients with effective transportation and logistics solutions since 1978.